Banks deal with financial and sensitive data, and therefore, need robust security and bank safety systems. One of the widely used security measures in modern banking is the utilisation of CCTV surveillance with the integration of AI. Requiring 360° security, modern banking has been observed using smart CCTV camera surveillance solutions that not only monitor everyday activities but also deter crimes. On a day-to-day basis, banks face multiple challenges like cyberattacks, ATM skimming, fraud, identity theft, and more. Over the past few decades, with the proliferation of the banking sector, the need for bank CCTV camera solutions has also increased.

To prevent and combat the growing rate of crime and other security concerns, modern AI-powered banking CCTV surveillance solutions have been introduced. In this article, you will learn how AI integration with CCTVs can help enhance security in the banking sector.

Key Physical Security Threats Faced by Banks

Banks face numerous physical security threats on an everyday basis. These are enumerated below:

Vandalism

This is the intentional destruction, defacement or arson of bank property, such as ATMs, walls, windows and furniture in the branch offices, connectivity and power cables, vehicles in the vicinity of the bank premises etc.

Unauthorized Access

Unauthorised access in banks involves individuals entering restricted or sensitive areas without proper permission, posing security risks, potential data breaches, and threats to personnel, assets, and confidential information. Hence constant monitoring of security in banks is needed to detect and prevent such illegal activities.

ATM Skimming and Fraud

ATM skimming refers to any attempt of trying to steal sensitive ATM card and bank account information by installation of a skimmer device secretively in the ATM machine, duplication of the data from the card when it is inserted, capturing the transaction PIN, and then cloning the card to withdraw money from a remote location. This is a serious compromise of security in banks, and has become increasingly frequent in recent years.

Internal Fraud or Data Breach

Internal fraud and data breach in banks involve employees or insiders stealing sensitive documents, accessing restricted areas, inserting pen-drives containing malware into the bank’s computers, or tampering with physical records. These breaches of security in banks often occur due to inadequate access control, poor monitoring, or lack of secure storage and bank surveillance, leading to compromised customer data and financial loss.

Natural Events

Natural events and disasters pose serious physical security threats to banks by damaging infrastructure, disrupting operations, and risking the safety of personnel and assets. Common threats include earthquakes, floods, hurricanes, tornadoes, landslides, fires caused by lightning or drought, and severe storms. These events can destroy vaults, disable security systems, and make bank premises inaccessible. Without proper preparedness—such as reinforced buildings, backup power, and emergency protocols—banks are vulnerable to financial loss, data compromise, and prolonged service outages during such natural crises.

Tailgating in Vaults

It is a form of security breach in which the tailgater or piggybacker positions himself or herself close behind the authorised person (usually an employee with legitimate access to the secured area of the bank), and then follows through the security checking gate in close proximity with the employee, taking advantage of the few seconds of delay in the closing of the gate. Tailgating in bank vaults exposes the customers to grave risks of asset theft, and thereby poses a serious risk for security in banks. Tailgating is difficult to thwart with conventional access control gates.

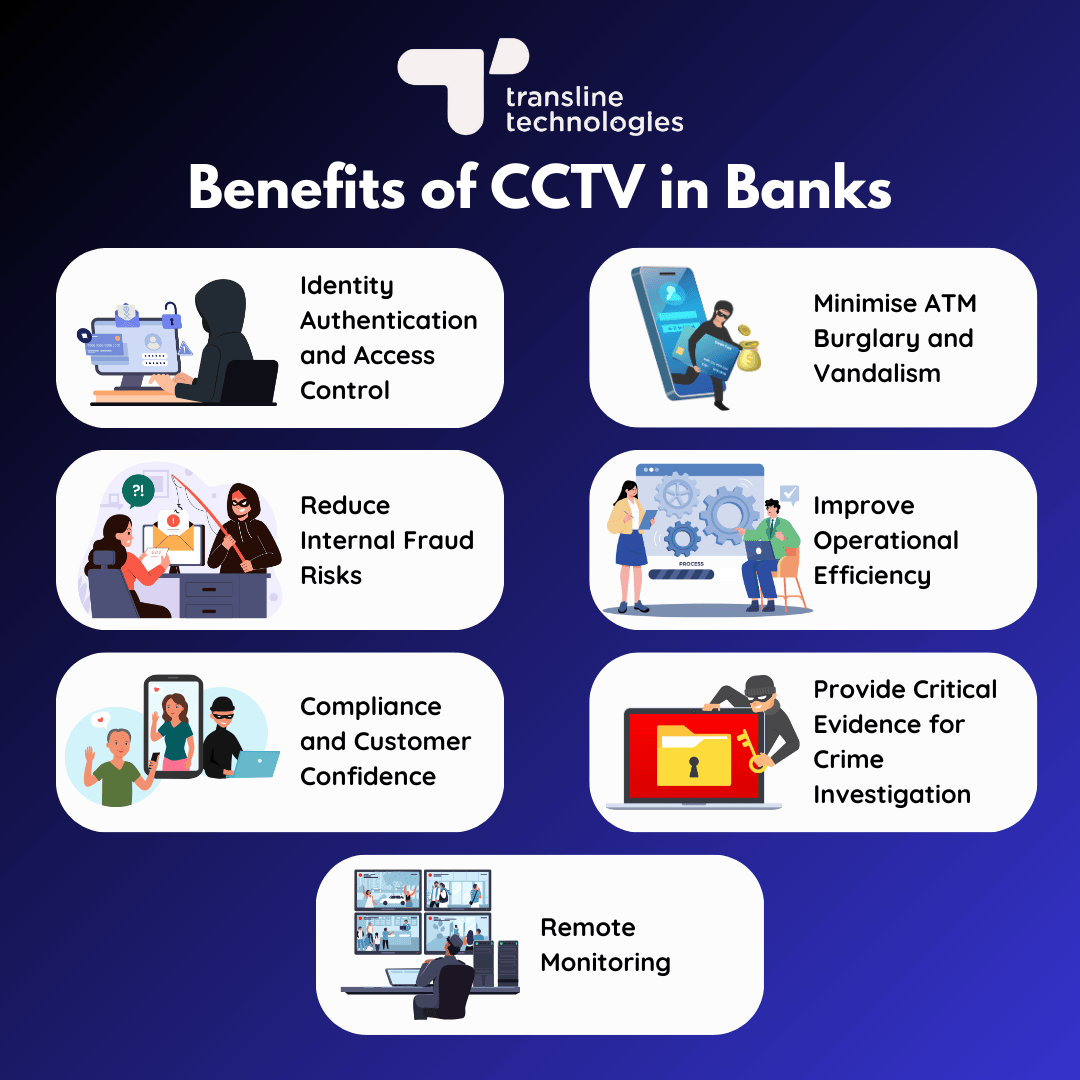

Benefits of CCTV Video Surveillance Systems in Banks

Bank CCTV Cameras serve a wide range of benefits. Some of these benefits are elucidated below as follows:

Reduce Internal Fraud Risks

Internal fraud, also referred to as insider fraud, includes fraud generally committed by bank employees. This may include physical theft, scamming, account manipulation, and more. According to a 2022 report, banks across 130+ countries faced a combined loss of $3.6 USD due to internal fraud. CCTV video footage can serve as proof or evidence in case of crimes, preventing offenders by creating a sense of risk for them. Continuous monitoring of bank staff holds them accountable and ensures proper functioning of day-to-day banking operations.

Identity Authentication and Access Control

Identity authentication is necessary as it verifies the identity of a user before giving access, preventing the chances of unauthorized access. Most banks require users to enter a password or PIN. Sometimes, there is a two-factor authentication, biometric identification, or other method of transaction authentication. Authorization or access control refers to the amount of control one user has over different aspects of banking. For example, an account holder can access their own account, while a bank employee might have broader access but no access to users' passwords or other sensitive details, preventing scams and thefts. CCTV bank surveillance helps monitor physical identity and authentication, preventing further risks of unauthorised access. This identity authentication and authorization setup, when integrated with CCTV surveillance, helps prevent several banking crimes, particularly identity-related thefts and scams, ultimately enhancing bank safety.

Remote Monitoring

Remote monitoring enables the senior management to monitor security in banks and branch operations in real-time. It helps keep track of who enters and exits a bank branch. Moreover, advanced banking CCTV surveillance solutions, especially those integrated with AI, can identify anomalies, i.e., unusual activity or abnormal behavior, including potential criminal actions. It also helps in tracking transactions, ATM activities, and employee behavior.

Minimise ATM Burglary and Vandalism

According to a Times of India article, most ATM burglary and vandalism cases have occurred due to the lack of adequate safety measures taken by bank authorities. The presence of CCTV cameras helps discourage individuals from committing theft or vandalism, ensuring bank safety. Continuous monitoring keeps them at risk of being caught, and in some cases, AI-powered bank surveillance systems can flag unusual behavior, helping prevent major thefts before they even occur. Moreover, in cases of vandalism or burglary, bank CCTV camera footage can help identify criminals and serve as potential evidence to bring them to justice.

Improve Operational Efficiency

AI-powered banking CCTV surveillance not only helps in monitoring banking operations but also in managing overcrowding. These modern systems instantly flag instances of overcrowding, allowing authorities to prevent potential risks such as crimes, accidents, or conflicts. Additionally, it helps reduce discomfort for both staff and customers, ensuring a safer and more efficient environment. Moreover, some AI-driven CCTV systems send real-time alerts in cases of delays, queue breaks, or non-compliance with rules, allowing for a smooth flow in the execution of banking processes.

Provide Critical Evidence for Crime Investigation

As per the studies on crimes in 2024, the registered banking frauds and crimes were more than thirteen thousand. The statistics over the years show a concerningly high and increasing rate. However, CCTV footage has been seen as an active factor in detecting criminals and has proved significant in investigations. Installation of CCTV cameras has helped police solve many cases. A burglary incident that took place at a major branch of the SBI bank was solved when it was found that the six offenders who were involved in committing the crime had entered through a window. This was the key point in the investigation that helped the police find them.

Compliance and Customer Confidence

When one knows they are being continuously monitored, they tend to behave with more accountability. Also, AI-driven Video Analytics tools like Storepulse AI and others help monitor compliance with rules. These smart solutions flag or send alerts when rules are not maintained, making CCTVs smarter and more effective. This encourages bank employees to work in compliance, making customers feel safe and secure. This also makes customers feel that banks are reliable and helps increase their confidence in banking authorities.

Challenges in Implementing Banking CCTV Surveillance

Despite the benefits that bank CCTV cameras offer in the smooth flow of banking operations, and the consequent growing popularity of bank surveillance solutions, the banking sector faces a number of challenges in implementing CCTV surveillance. Some of these challenges are elucidated below:

Privacy Concerns

Maintaining privacy standards and regulatory laws is crucial when considering the installation of CCTV surveillance solutions. There are certain regulatory laws set by the government of each country, and therefore, installing CCTV systems while considering these factors is the ideal way to comply. Privacy is an important concern and shouldn’t be compromised. The stored footage should only be accessible to a few authorized individuals, and strictly for compliance purposes. Bank CCTV camera footage may be accessed only by relevant law enforcement agencies in the case of crime investigation.

Cost Considerations

The installation cost for CCTV cameras may vary from provider to provider. There are certain factors that influence this cost, including the quantity of cameras to be installed, the type of CCTV cameras, the human resources required for installation, the scope of the project, and the time involved. Other smart features, such as integration with AI tools and features, can also add to the cost. However, if considered wisely, one can opt for reliable, economical, and smart solution providers like Transline Technologies.

Effectiveness

CCTVs do monitor banking activities but may face several challenges. For example, low-quality footage can hinder the identification of criminals, rendering them ineffective. Moreover, their performance depends heavily on network and power supply; outages can result in missing feeds, making accurate monitoring difficult. Bank CCTV cameras also require high maintenance, which can significantly increase costs. Additionally, blind spots and limited coverage often make investigations and proper tracking more difficult.

Data Breach and Cybersecurity Threats

Data breaches and cybersecurity threats are among the most common risks faced by banks. A study shows that the banking sector experienced a 238% increase in cyberattacks in 2020. Often, these breaches originate from insiders such as banking staff and have caused significant losses in the past. This continues to be a major challenge in the industry. However, many banks have adopted smart CCTV solutions and data-protected software to detect and prevent such crimes in advance.

Legal and Regulatory Restrictions

Generally, banks are obligated to have CCTVs installed as per government rules and orders. There are specific areas and vital points where installation is mandatory. However, bank CCTV camera systems must comply with certain legal regulations, which can at times restrict effective monitoring. These legal and regulatory constraints can sometimes hamper effective monitoring and may, in some cases, lead to crimes or breaches. These regulations are primarily in place to protect customer privacy and to prevent unauthorized access or misuse of power by a single individual.

The Future of Bank Safety: AI Powered Bank CCTV Cameras

At Transline Technologies, we have been empowering Public Sector and Private Banks across India with modern bank surveillance systems. Our AI powered CCTV Surveillance, Video Analytics and Biometric & Facial Recognition systems help enhance security in banks with stringent access management, tailgating prevention, vandalism detection, fire hazard alerts and other real-time monitoring solutions.

Connect with Our Team today to explore how you can leverage the power of AI- driven Bank Surveillance to bolster security in banks.